As a responsible Indian taxpayer, keeping up with the evolving income tax landscape is crucial. In recent years, the government has introduced significant reforms to the country’s taxation system, aiming to simplify compliance, enhance fairness, and provide greater benefits to individual taxpayers. In this comprehensive article, we will delve into the key highlights of India’s recent income tax reforms, exploring the nuances of the new tax regime, deductions and exemptions, and the implications for taxpayers navigating this dynamic landscape.

The Shift to the New Tax Regime

The 2023 Union Budget marked a pivotal moment in India’s income tax history, as the government introduced the new tax regime as the default option for individual taxpayers. This shift aims to provide a more streamlined and transparent taxation system, catering to the diverse needs of the modern Indian workforce.

Simplified Tax Structure

One of the primary objectives of the new tax regime is to simplify the income tax structure. By reducing the number of deductions and exemptions, the new regime seeks to minimize the complexities associated with tax planning and compliance. This approach aligns with the government’s goal of creating a more straightforward and user-friendly taxation system.

Enhanced Basic Exemption Limit

A notable change under the new tax regime is the increase in the basic exemption limit from ₹2.5 lakhs to ₹3 lakhs. This enhancement allows taxpayers to retain a larger portion of their income without incurring any tax liability, making the new regime more appealing to a broader range of individuals.

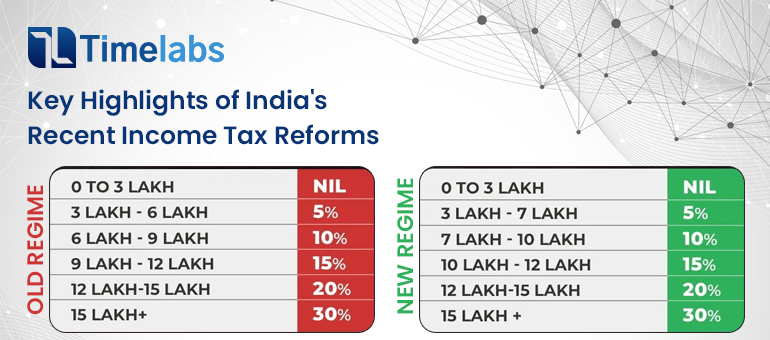

Revised Tax Slab Rates

The new tax regime introduces revised tax slab rates, providing taxpayers with the opportunity to benefit from lower tax rates on certain income slabs. The revised slabs and corresponding tax rates are as follows:

| Income Slab | Tax Rate |

| Up to ₹3,00,000 | 0% |

| ₹3,00,001 to ₹7,00,000 | 5% |

| ₹7,00,001 to ₹10,00,000 | 10% |

| ₹10,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

These changes aim to provide taxpayers with greater flexibility and the potential to optimize their tax liability.

Deductions and Exemptions under the New Regime

The new tax regime introduces a simplified approach to deductions and exemptions, with the goal of reducing the compliance burden for taxpayers.

Withdrawal of Certain Deductions

Under the new regime, around 70 deductions and exemptions that were previously available under the old tax regime have been withdrawn. This move is intended to simplify the tax filing process and encourage taxpayers to focus on their core financial goals rather than complex tax planning strategies.

Retained Deductions

Despite the withdrawal of numerous deductions, the new tax regime still allows for certain deductions to be claimed, including:

- Deductions for travel allowance related to employment transfers

- Deductions under Section 32, excluding additional depreciation

- Deductions under Section 80JJAA for new employees

- Deductions for investments in the Notified Pension Scheme under Section 80CCD(2)

- Deductions for conveyance allowance due to work-related travel

- Deductions for transport allowance for specially-abled individuals

These retained deductions aim to provide taxpayers with some flexibility in optimizing their tax liability.

Comparison: Old Tax Regime vs. New Tax Regime

As taxpayers navigate the new tax regime, it is essential to understand the key differences between the old and new tax regimes to make an informed decision.

Tax Rates and Slabs

One of the most significant differences lies in the tax rates and income slabs. The new tax regime offers lower tax rates on certain income slabs, potentially resulting in lower tax liabilities for some taxpayers.

Deductions and Exemptions

The old tax regime provided a wider range of deductions and exemptions, allowing taxpayers to claim various tax-saving benefits. In contrast, the new tax regime has a more streamlined approach, with the withdrawal of around 70 such deductions and exemptions.

Flexibility in Choosing Regimes

Taxpayers now have the option to choose between the old and new tax regimes, depending on their individual circumstances and financial goals. This flexibility allows them to select the regime that best suits their needs.

Irreversible Regime Selection

It’s important to note that once a taxpayer opts for the new tax regime, they cannot switch back to the old regime during the same financial year. However, they can choose to switch between the regimes in subsequent years.

Surcharge Rate Revisions

The new tax regime has also brought about changes to the surcharge rates applicable to high-income taxpayers.

Reduced Surcharge Rate

For taxpayers with an income above ₹5 crores who opt for the new tax regime, the surcharge rate has been reduced from 37% to 25%. This reduction aims to provide relief to high-income earners and enhance the attractiveness of the new tax regime.

Updated Surcharge Rate Structure

The updated surcharge rate structure under the new tax regime is as follows:

| Taxable Income | Surcharge Rate |

| Less than ₹50 lakhs | 0% |

| ₹50 lakhs to ₹1 crore | 10% |

| ₹1 crore to ₹2 crores | 15% |

| ₹2 crores to ₹5 crores | 25% |

| Above ₹5 crores | 25% |

These changes aim to provide relief to high-income taxpayers while maintaining a progressive tax structure.

Tax Rebate Enhancements

Another significant change introduced in the new tax regime is the enhancement of the tax rebate under Section 87A.

Increased Rebate Limit

The tax rebate limit has been increased from ₹12,500 to ₹25,000 for taxpayers with a taxable income of up to ₹7 lakhs. This change effectively eliminates the tax liability for individuals with a taxable income of ₹7 lakhs or less, making the new tax regime more attractive for lower-income taxpayers.

Expanded Rebate Eligibility

The eligibility for the Section 87A rebate has also been expanded, with the taxable income limit being raised from ₹5 lakhs to ₹7 lakhs. This change ensures that a larger segment of the population can benefit from the tax rebate.

Standard Deduction Revisions

The new tax regime has introduced changes to the standard deduction available to salaried individuals and pensioners.

Increased Standard Deduction

The standard deduction for salaried individuals has been increased from ₹50,000 to ₹75,000, providing an additional tax benefit to this segment of taxpayers.

Enhanced Family Pension Deduction

The standard deduction for family pensioners has also been increased from ₹15,000 to ₹25,000, recognizing the unique financial circumstances of this group.

These enhancements to the standard deduction aim to provide greater tax relief and support to salaried individuals and pensioners.

New Deductions and Exemptions

In addition to the retained deductions, the new tax regime has introduced a few new deductions and exemptions.

Agniveer Corpus Fund Deduction

Taxpayers can now claim a deduction for the amount paid or deposited in the Agniveer Corpus Fund under Section 80CCH(2). This deduction is aimed at supporting the government’s Agniveer scheme, which provides opportunities for youth to serve in the armed forces.

Family Pension Deduction

Taxpayers receiving family pensions can now claim a deduction of ₹15,000 or one-third of the pension amount, whichever is lower, under the new tax regime.

These new deductions and exemptions further enhance the tax benefits available to taxpayers under the new regime.

Implications for Taxpayers

The introduction of the new tax regime has significant implications for individual taxpayers in India.

Simplified Tax Planning

The simplified structure of the new tax regime, with the withdrawal of numerous deductions and exemptions, can streamline the tax planning process for taxpayers. This shift encourages a more straightforward approach to managing one’s tax liability.

Potential Tax Savings

The new tax regime may offer potential tax savings depending on an individual’s income, investment patterns, and financial goals. Taxpayers should carefully analyze their specific circumstances to determine the most favorable regime.

Compliance Burden Reduction

The new tax regime’s focus on simplicity aims to reduce the burden of compliance for taxpayers. With fewer deductions and exemptions to track, the filing process may become more efficient and less time-consuming.

Flexibility in Regime Selection

The ability to choose between the old and new tax regimes allows taxpayers to optimize their tax liability based on their evolving financial circumstances. This flexibility can be particularly beneficial for those with varying sources of income or changing investment patterns over time.

Navigating the New Tax Landscape

As taxpayers in India navigate the evolving income tax landscape, it is crucial to stay informed and make well-informed decisions.

Seek Professional Guidance

Consulting with tax professionals or utilizing online tax calculators can help taxpayers assess the potential tax implications under the old and new regimes, enabling them to make an informed choice.

Review Financial Plans Regularly

Taxpayers should regularly review their financial plans and tax strategies to ensure they are taking advantage of the benefits offered by the new tax regime while also aligning with their long-term financial goals.

Stay Updated on Tax Reforms

Keeping abreast of the latest changes and updates to the income tax regulations, including any future revisions to the new tax regime, will empower taxpayers to make timely and informed decisions.

Conclusion

The introduction of the new tax regime in India represents a significant step towards simplifying the country’s income tax system and providing greater benefits to individual taxpayers. By understanding the key highlights of these reforms, including the revised tax slabs, deductions and exemptions, surcharge rate changes, and the flexibility to choose between regimes, taxpayers can navigate this evolving landscape and optimize their tax liability.

As the government continues to refine and enhance the taxation system, it is crucial for taxpayers to stay informed, seek professional guidance, and adapt their financial strategies accordingly. By embracing the opportunities presented by the new tax regime, individuals in India can align their tax planning with their broader financial objectives, ultimately contributing to their long-term financial well-being.